April is a tax tech startup building embeddable tax products, and partnering with fintechs and banks to deliver tax filing wherever users are making other financial decisions.

My Role

I led research, design, and user testing for this project from end to end. I collaborated with a product manager from scoping the project through QA.

Problem

From the business perspective, the problem is that tax is a seasonal business and it is difficult to compete with incumbents in the space with users only interacting with your product for one quarter every year.

Through generative research, we uncovered a problem facing users that could help us move past the seasonality of the business. For most users, taxes come up once a year and are an event that feels out of their hands. They don’t realize they have levers to pull throughout the year to impact their tax situation

Goals

- Help users get a clearer picture of their tax situation

- Increase understanding of tax concepts

- Allow users to take action to impact their tax situation

- Gain users in the off season

Outcome and Impact

We launched the Estimator with our partner Gusto, followed a month later by the Optimizer. In our pilot had over 10k users Estimate their taxes, with 15% going on to make changes to tax withholding.

For the next phase of work on the product we identified opportunities to enhance the experience, and increase the supported tax situations beyond a simple W-2. We also Identified an opportunity to expand the ability to adjust withholdings to non payroll provider partners.

The Challenge

When I spoke with users, almost all who had worked a full-time job knew vaguely about a form W-4, but familiarity was where their understanding stopped. Most had no idea how to fill out the form, or that you could make changes to that form at any point in the year. Furthermore many didn’t realize that was one of the major contributing factors to their tax situation at the end of the year.

Additionally, most users that had received a large tax refund, didn’t know that they didn’t need to wait for the end of the year to get that money and that they could withhold less, and get a larger paycheck.

The final challenge was how do we build a product that is a fast enough flow to not see too many users drop mid flow, but still collect enough information to form an accurate estimate.

User Testing

Usability Test

Users had a good understanding of the flow, including leaving the partner site and coming into the April ecosystem. The transition was so clear, we eliminated a hand off page that was scoped as part of the flow. We also saw that users would prefer to have data brought in by the partner app, but only once they had reviewed and signed off. This informed a later project related to partner data and OCR.

Comparison Test

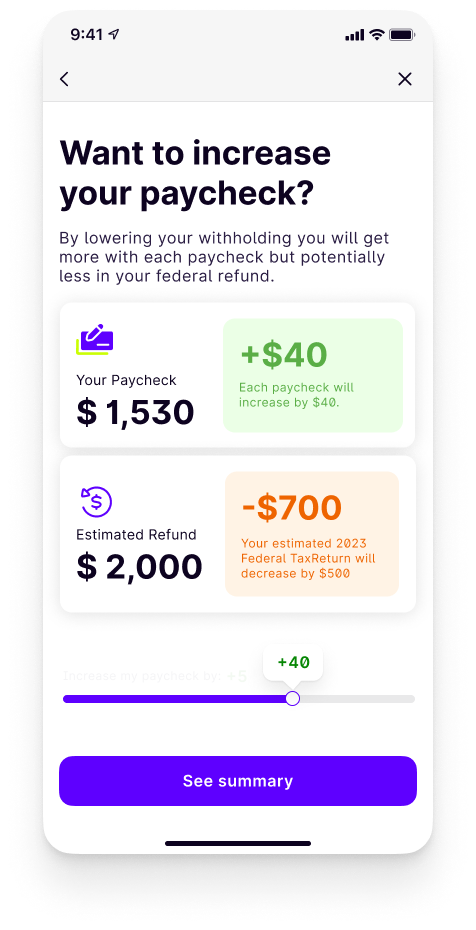

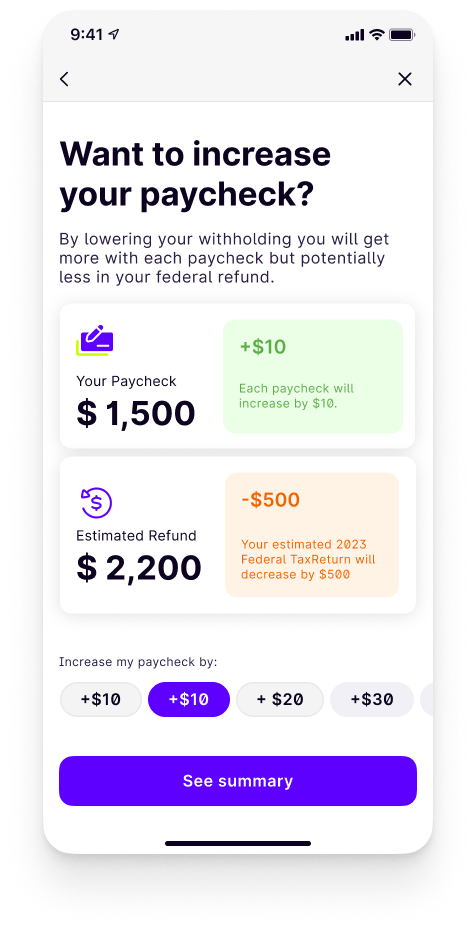

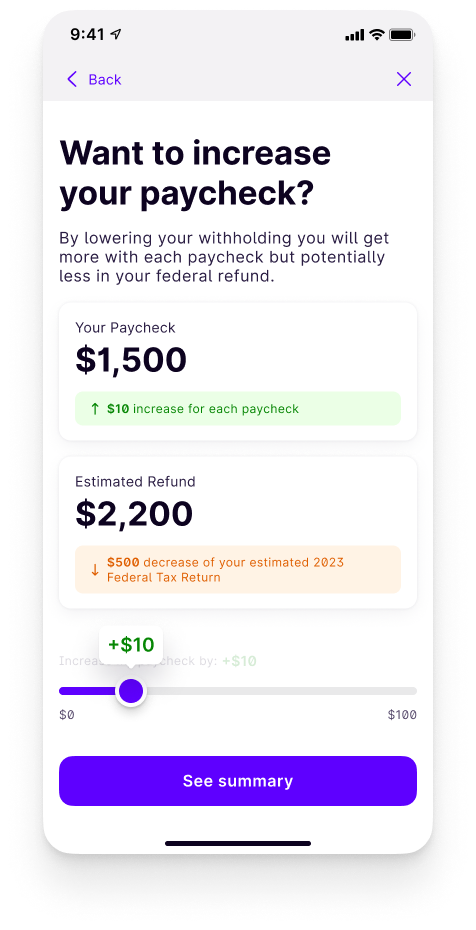

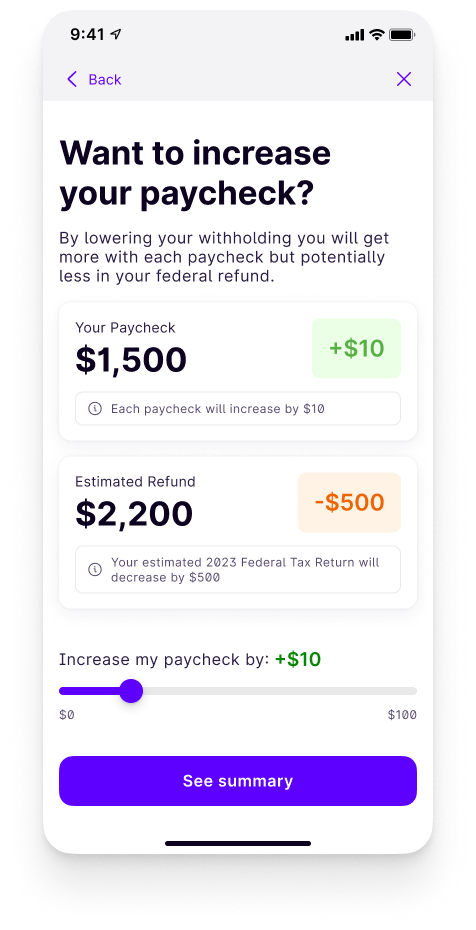

In the comparison test, we watched users interact with three versions of the withholding adjustment interaction. The set increments frustrated users, who felt locked into how much to change the paycheck. The Opposing sliders caused some confusion but users were all able to make the change, and understand the relationship between withholding and refund. The single slider also made the relationship clear, but was faster for users to make an adjustment and move on, so it came out as the winner.